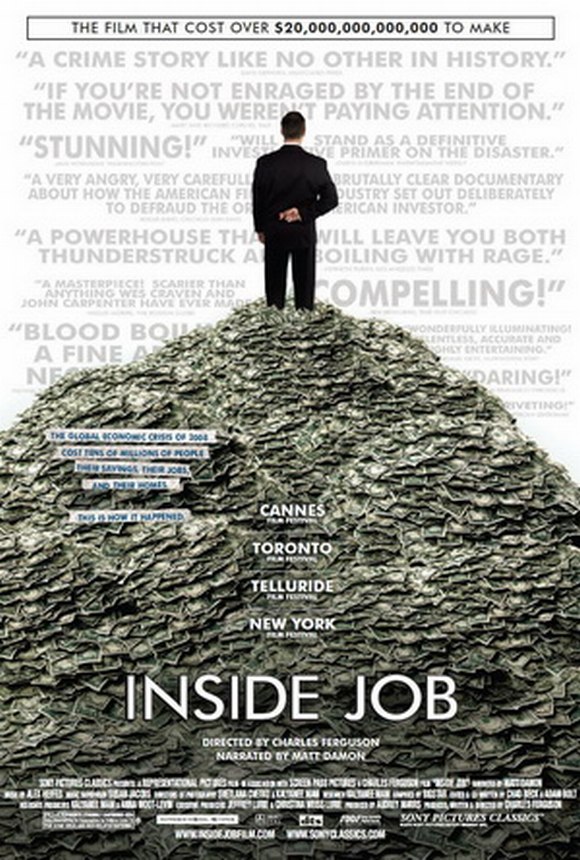

Inside Job (2010) е документален филм на Чарлс Фъргюсън (Charles H. Ferguson) за финансовата криза от края на първото десетилетие на двадесет и първи век. Според самия Фъргюсън, филмът е за „систематичната корупция във финансовия сектор на САЩ и последиците от тази корупция.“ В петте си части филмът изследва как промените в регулациите и банковите практики са спомогнали за създаването на кризата. Филмът е спечелил Оскар (Academy Award) в категорията „Най-добър документален филм“ . (Тук филмът е с български субтитри – кликнете на иконката на малкото телевизорче, за да го гледате на голям екран).

Inside Job

The documentary is in five parts.

It begins with a look at how Iceland was highly deregulated in 2000 and its banks were privatized. When Lehman Brothers went bankrupt and AIG collapsed on September 15, 2008, Iceland and the rest of the world went into a global recession.

Part I: How We Got Here

The American financial industry was regulated from 1940 to 1980, followed by a long period of deregulation. At the end of the 1980s, a savings and loan crisis cost taxpayers about $124 billion. In the late 1990s, the financial sector had consolidated into a few giant firms. In 2001, the Internet Stock Bubble burst because investment banks promoted Internet companies that they knew would fail, resulting in $5 trillion in investor losses. In the 1990s, derivatives became popular in the industry and added instability. Efforts to regulate derivatives were thwarted by the Commodity Futures Modernization Act of 2000, backed by several key officials. In the 2000s, the industry was dominated by five investment banks (Goldman Sachs, Morgan Stanley, Lehman Brothers, Merrill Lynch, and Bear Stearns), two financial conglomerates (Citigroup, JPMorgan Chase), three securitized insurance companies (AIG, MBIA, AMBAC) and three rating agencies (Moody’s, Standard & Poors, Fitch). Investment banks bundled mortgages with other loans and debts into collateralized debt obligations (CDOs), which they sold to investors. Rating agencies gave many CDOs AAA ratings. Subprime loans led to predatory lending. Many home owners were given loans they could never repay.

Part II: The Bubble (2001-2007)

During the housing boom, the ratio of money borrowed by an investment bank versus the bank’s own assets reached unprecedented levels. The credit default swap (CDS), was akin to an insurance policy. Speculators could buy CDSs to bet against CDOs they did not own. Numerous CDOs were backed by subprime mortgages. Goldman-Sachs sold more than $3 billion worth of CDOs in the first half of 2006. Goldman also bet against the low-value CDOs, telling investors they were high-quality. The three biggest ratings agencies contributed to the problem. AAA-rated instruments rocketed from a mere handful in 2000 to over 4,000 in 2006.

Part III: The Crisis

The market for CDOs collapsed and investment banks were left with hundreds of billions of dollars in loans, CDOs and real estate they could not unload. The Great Recession began in November 2007, and in March 2008, Bear Stearns ran out of cash. In September, the federal government took over Fannie Mae and Freddie Mac, which had been on the brink of collapse. Two days later, Lehman Brothers collapsed. These entities all had AA or AAA ratings within days of being bailed out. Merrill Lynch, on the edge of collapse, was acquired by Bank of America. Henry Paulson and Timothy Geithner decided that Lehman must go into bankruptcy, which resulted in a collapse of the commercial paper market. On September 17, the insolvent AIG was taken over by the government. The next day, Paulson and Fed chairman Ben Bernanke asked Congress for $700 billion to bail out the banks. The global financial system became paralyzed. On October 3, 2008, President Bush signed the Troubled Asset Relief Program, but global stock markets continued to fall. Layoffs and foreclosures continued with unemployment rising to 10% in the U.S. and the European Union. By December 2008, GM and Chrysler also faced bankruptcy. Foreclosures in the U.S. reached unprecedented levels.

Part IV: Accountability

Top executives of the insolvent companies walked away with their personal fortunes intact. The executives had hand-picked their boards of directors, which handed out billions in bonuses after the government bailout. The major banks grew in power and doubled anti-reform efforts. Academic economists had for decades advocated for deregulation and helped shape U.S. policy. They still opposed reform after the 2008 crisis. Some of the consulting firms involved were the Analysis Group, Charles River Associates, Compass Lexecon, and the Law and Economics Consulting Group (LECG).

Part V: Where We Are Now

Tens of thousands of U.S. factory workers were laid off. The new Obama administration’s financial reforms have been weak, and there was no significant proposed regulation of the practices of ratings agencies, lobbyists, and executive compensation. Geithner became Treasury Secretary. Feldstein, Tyson and Summers were all top economic advisors to Obama. Bernanke was reappointed Fed Chair. European nations have imposed strict regulations on bank compensation, but the U.S. has resisted them.

Budget $2 million

Box office $7,871,522

Total Lifetime Grosses

Domestic: $4,312,735 54.8%

+ Foreign: $3,558,787 45.2%

Американците са дресирани да вярвят, че Бог има план за всеки един от тях. Друг е въпросът колко от тях съзнават, че преди да стигнат при Бога, „Богът“ на съвременото общество – финансовите институции, също има план за тях!? И тия които го осъзнават никак не им е весело.

Но както се казва всяко зло за добро. Финансовите инститции ускоряват срещата на хората с Бога, както и разрухата на самото общество. В причиноследствената връзка всяко нещо си има „цена“ – и тези, които го съзнават и тези, които не – ще я платят!

Единственият „безценен диамант“ в ръцете на финансовите институции е глупостта на тълпата. Върху нея се гради капиталът и властта на Капитала.

Внутреннее дело – Inside Job 2010 (рус. субтитры)

http://rutube.ru/tracks/4226556.html

http://rutracker.org/forum/viewtopic.php?t=3511194

http://ru.podnapisi.net/en/inside-job-2010-субтитры-p1153877