Loan approvals and mortgages could be delayed, but experts think the housing market would bounce back.

With a dispute in the Senate over the immigration program DACA still unresolved, the government shutdown continues for a third day on Monday morning after Congress’s failed attempts to pass a spending deal that would fund the government through mid-February.

With a dispute in the Senate over the immigration program DACA still unresolved, the government shutdown continues for a third day on Monday morning after Congress’s failed attempts to pass a spending deal that would fund the government through mid-February.

A Senate vote on an agreement that would end the shutdown and fund the government for another three weeks is scheduled for noon ET Monday. Whether the plan will gain enough support from Democrats is unclear, according to CNN, but until business as usual resumes, homebuyers and sellers could be in store for headaches — but not any long-term setbacks.

During a shutdown, the Internal Revenue Service (IRS), Social Security Administration and the Department of Housing and Urban Development (HUD) furlough large swaths of workers, significantly delaying mortgage approval until work resumes.

Banks and private lenders will operate as usual, housing experts told Inman News. But the mortgage applications they approve or deny include tax records and financials requiring certification. Fannie Mae and Freddie Mac, despite being government-sponsored enterprises, are not government agencies — and therefore are not affected.

At HUD, which oversees the Fair Housing Act, nearly all of the agency’s approximately 8,500 employees are prohibited from working during a shutdown, which puts a halt to all “meetings, visits and appearances” by HUD employees. Borrowers who apply for loans through the Federal Housing Administration (part of HUD) or the Department of Veterans Affairs will face delays.

National Association of Realtors President Elizabeth Mendenhall emphasized that a long-term shutdown could pose larger problems for the housing market and called on senators to vote in favor of a budget extension Friday.

On Thursday, House Republicans voted to extend a budget deadline past Friday, but without concessions on immigration, including permanent protection for so-called Dreamers in the federal DACA program, 45 Senate Democrats and five Senate Republicans voted against the measure, triggering the shutdown.

“The government shutdown will have an impact on real estate transactions should it continue for an extended period of time,” said Mendenhall in a prepared statement. “The National Association urges Congress to come together and reach an agreement to keep the government open and avoid any negative effects on our military, federal employees, housing markets and the economy.”

The overall impact of a shutdown on the economy or housing market, however, will likely be negligible, since mortgage approval would resume eventually, said economists at Redfin and the National Association of Realtors. In October 2013, during which the government shut down for two weeks, sales volume declined modestly nationwide and in Washington D.C. but rebounded soon after government employees returned to work, according to Redfin data. Total sales volume declined 16.9 percent, month over month, but rebounded over several months.

“At the time it was a big deal for the government to shut down for a couple of weeks and there was a lot of concern, but what that ended up being was just a blip on the radar screen for both housing and the economy,” Redfin Chief Economist Nela Richardson told Inman. “It didn’t really amount to a hill of beans. So maybe there’s a false comfort that we can easily shut down the government without economic impact. That could be proven wrong, but what we have to go by is what happened the last time around, and it just didn’t make that much of a difference.”

BY JOTHAM SEDERSTROM www.inman.com

Government Shutdown And Effects To Mortgage Programs

-

- For those who have mortgage loans pending whether with me or other mortgage lenders, mortgage loan borrowers should not worry.

- Government shutdown does not mean that the whole government will shut down.

- All money producing institutions will remain open.

- What is a revenue producing institution?

- The United States Postal Service collects revenue from selling stamps and delivering packages so this will be considered a revenue producing institution.

- Being a revenue producing institution, the United States Postal Service will remain open. Amtrack will remain open.

- Air Traffic Controllers and TSA will remain open and functional because they are revenue producing entities.

- The United States Armed Forces and federal law enforcement agencies will not be affected by the government shutdown.

Government Shutdown And Effects To Mortgage Programs & How It Will Affect Consumers

- FHA: Has indicated they will continue to endorse loans, and TOTAL and the FHA Connection will be fully functional.

- VA: Will continue business as usual.

- USDA: Will not issue new commitments or guarantees during a shutdown period.

- CAIVRS: Will be available to determine if a borrower has a delinquent federal debt

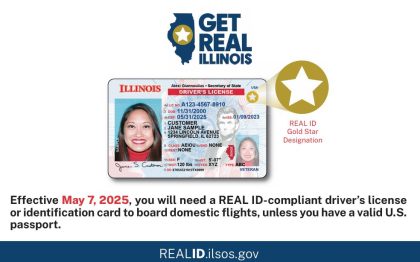

- IRS Validations (4506T) The Internal Revenue Service (IRS) has indicated that they will not process any forms, including issue tax return transcripts

- Social Security Administration (SSA) Social Security validations will not be able to be processed

Government shutdown would create roadblocks in the housing market

-

- The government shutdown will give homebuyers and sellers more headaches than usual before their deals close.

- That’s because buyers looking for mortgage approval could hit paperwork roadblocks if the shutdown furloughs workers at the IRS or Social Security Administration.

- Here’s how the shutdown could make buying or selling a home even more stressful

While lenders use government guidelines for mortgage approvals, the decision ultimately belongs to the lenders. That’s not the problem.

As anyone who has applied for a mortgage learns the hard way, the application includes a big stack of paper documenting your financial status, including records like tax returns.

In most cases, lenders want to verify all that paperwork, especially after the housing crash a decade ago when lenders went light on documentation, an approach that ended badly.

The government shut down, includes workers at the IRS who are usually asked to verify the tax returns aspiring homebuyers submit to their mortgage lenders. (If you hear there’s a problem with IRS Form 4056-T, you may have hit that particular roadblock.)