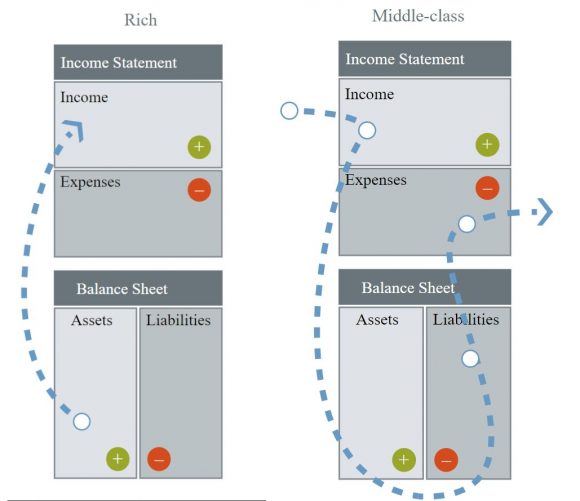

Rich people acquire assets. On the other hand, the reason why the poor and middle class do not become rich is because they acquire liabilities that they think are assets. They miss out on buying income-generating assets because first and foremost, they don’t know the difference of assets vs liabilities.

But what exactly is the difference of assets vs liabilities? According to Rich Dad*, it is the direction of cash flow that determines if something is an asset or a liability at that moment.

What are Assets and Liabilities?

Written by Robert Kiyosaki

Understanding the true definition is the key to getting rich

A lot of people come to me asking how they can get rich quick. That is the one question that disturbs me the most because it’s the wrong question. It tells me that they don’t have the foundation of financial intelligence required to use their money well if they get rich.

This is because most people don’t understand that, when it comes to being rich, it’s not about how much money you make. It’s about how much money you keep.

Thankfully, my rich dad took the time to teach me about money and poured a strong, financial foundation for my life.

And the number one rule he taught me was: „You must learn the difference between an asset and a liability—and buy assets.“

It’s so simple a rule that it’s almost anti-climactic. But, if you want to be rich, this is all you need to know. It’s rule number one. It’s the only rule.

The reality is that most people struggle financially because they don’t know the difference between an asset and a liability. Partly, this is because schools don’t teach people what an asset and a liability is. And partly, this is because those who do learn the concepts learn them from accountants who make them much too complicated.

My rich dad gave me a very simple definition of an asset and a liability.

What is an asset?

The simple definition of an asset is something that puts money in your pocket. Many so-called experts on money and accountants will have a much different definition that involves complex mathematics, but the reality is that unless something is putting money in your pocket, it’s not an asset.

There are many things that can be considered assets. These include things like investment real estate, a business, products like books or art, or the dividends from stock and bond investments.

Rich people focus on building their assets.

What is a liability?

The simple definition of a liability is something that takes money out of your pocket. Common liabilities include things like cars, vacations, clothes, eating out, unused subscriptions, and more.

If you look at the budget of a poor person, you’ll see that it is full of liabilities and has no assets.

The interesting thing is that there are some things that people mistake as assets that are really liabilities. This is because they don’t have high financial intelligence and they take at face value the advice of so-called financial experts.

The difference between an asset and a liability

To illustrate this, let’s look at something most people view as an asset—their home. If you look a traditional balance sheet, your house will be listed in the asset column.

For many decades, since the publishing of Rich Dad Poor Dad, I’ve stirred controversy by saying, “You house is not an asset.” At its publishing, the financial industry howled and mocked me for saying this. In 2008, the start of the Great Recession, caused by massive defaults on sub-prime home loans, people weren’t laughing any more.

Why was this?

It was because they realized the hard truth that many things that are considered assets by accountants and finance people are really liabilities hiding behind smoke and mirrors.

Let’s revisit the Rich Dad simple definition of an asset and a liability: an asset is something that puts money in your pocket and a liability is something that takes money out of your pocket.

Using this simple and practical definition, your home is a liability because it takes money out of your pocket each month in the form of a mortgage, taxes, insurance, and maintenance costs. It does not put money in your pocket. Only if you’re able to sell it at a profit does it become an asset. Many people impacted by the Great Recession discovered that their house was a liability when they were foreclosed, sold on a short sale, or sold at a loss.

Conversely, a rental house can be an asset, if you do your due diligence correctly and are able to collect more rent than you have costs each month. The difference between the rent and the expenses is the net operating income, and it is cash flow that flows into your pockets each month. Therefore, it is an asset.

The rich don’t work for money

I find the difference between an asset and a liability is best understood by looking at the following picture (cash flow patterns of the middle-class and rich).

‘

Very simply, the rich don’t work for money in the form of income like employees do. Rather, the rich invest their money in assets that put more money in their pockets, such as real estate, stocks, bonds, notes, and intellectual property.

The middle class and poor work for money and employees and invest their money in liabilities that take money out of their pockets such as mortgages, consumer loans, and credit card debt.

Here is an overview of some rich dad’s lessons:

“Rule #1:

You must know the difference between an asset and a liability, and buy assets. If you want to be rich, this is all you need to know. It is rule number one. It is the only rule. This may sound absurdly simple, but most people have no idea how profound this rule is. Most people struggle financially because they do not know the difference between an asset and a liability. “Rich people acquire assets. The poor and middle class acquire liabilities that they think are assets.”

#2

“When your assets generate enough income to cover your expenses, you are wealthy, even if you are not yet rich.”

#3

“An intelligent person hires people who are more intelligent than he is.”

#4

“Many financial problems are caused by trying to keep up with the Joneses.”

#5

“Once you understand the difference between assets and liabilities, concentrate your efforts on buying income-generating assets.”

#6

“An asset puts money in your pocket. A liability takes money from your pocket.”

#7

“When I want bigger house. I first buy the assets that will generate the cash flow to pay for the house.”

#8

“The three most important management skills necessary to start your own business are management of: cash flow, people, personal time.”

#9

“The old-money people, the long-term rich, build their asset column first. Then the income generated from the asset column buys their luxuries. The poor and middle class buy luxuries with their own sweat, blood, and children’s inheritance.”

#10

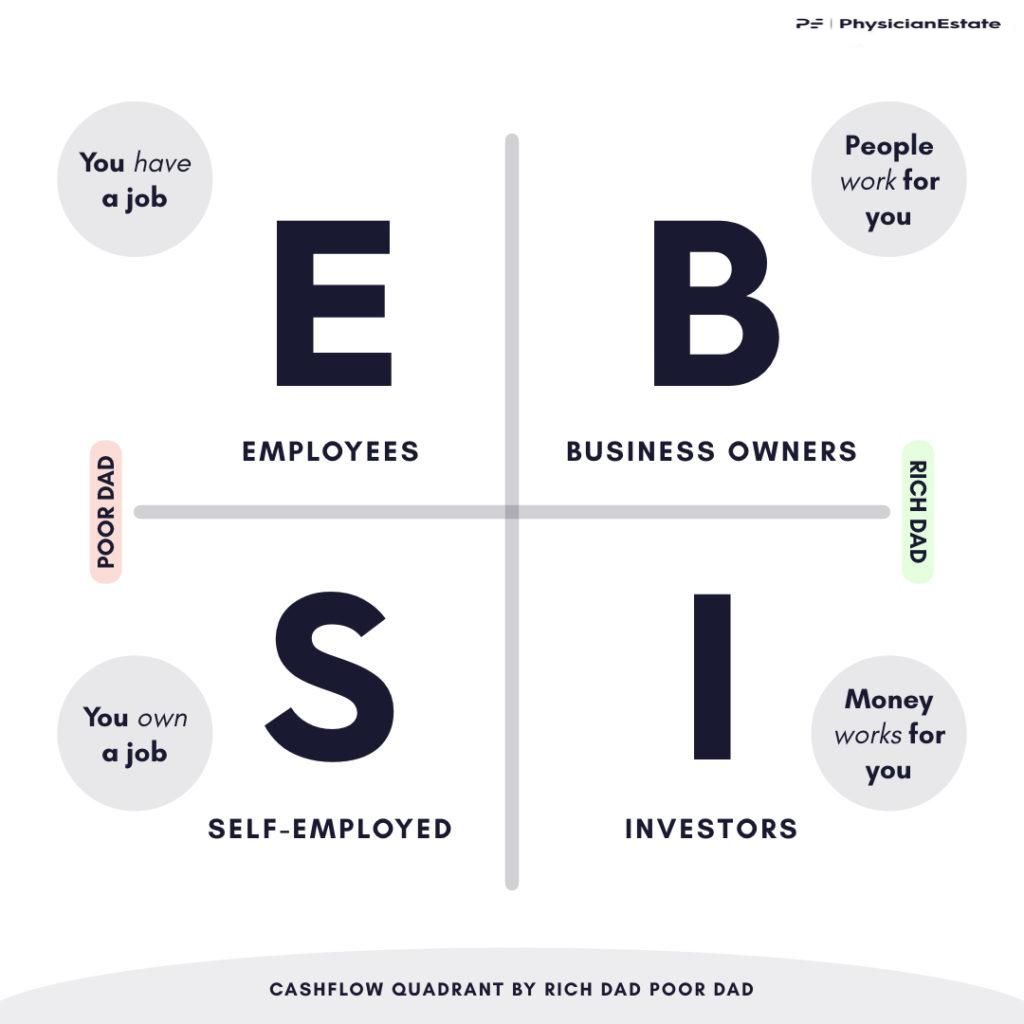

“The poor and the middle-class work for money. The rich have money work for them.”

#11

“Wealth is a person’s ability to survive so many number of days forward—or, if I stopped working today, how long could I survive?”

#12

“The philosophy of the rich and the poor is this: the rich invest their money and spend what is left. The poor spend their money and invest what is left.”

#13

“Always start at the end before you begin. Professional investors always have an exit strategy before they invest. Knowing your exit strategy is an important investment fundamental.”

#14

“Money is only an idea. If you want more money simply change your thinking. Every self-made person started small with an idea, then turned it into something big. It takes only a few dollars to start and grow into something big.”

#15

“When I decided to exit the rat race, it was simply a question of ‘How can I afford to never work again?’ And my mind began to kick out answers and solutions.”

Robert Kiyosaki, Rich Dad Poor Dad

‘

–––––––––––––––––––––––––––-

* We self-published Rich Dad Poor Dad in April 1997. The book was on the Wall Street Journal, the New York Times and Businessweek bestseller lists for years. In 2000, Oprah called and I appeared on her show. That show and the book went worldwide in an instant. Today, Rich Dad Poor Dad has become the #1 bestselling personal finance book of all time.

CASHFLOW Quadrant was my 2nd book. To this day it remains a major bestseller in the U.S. and around the world.

See more: The Myth of the Rich Doctor

.